ny paid family leave tax code

What category description should I choose for this box 14 entry. Request For Paid Family Leave Form PFL-1 with the required additional form to the employers PFL insurance carrier listed on Part B of.

Filing Taxes For Deceased With No Estate H R Block

After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program.

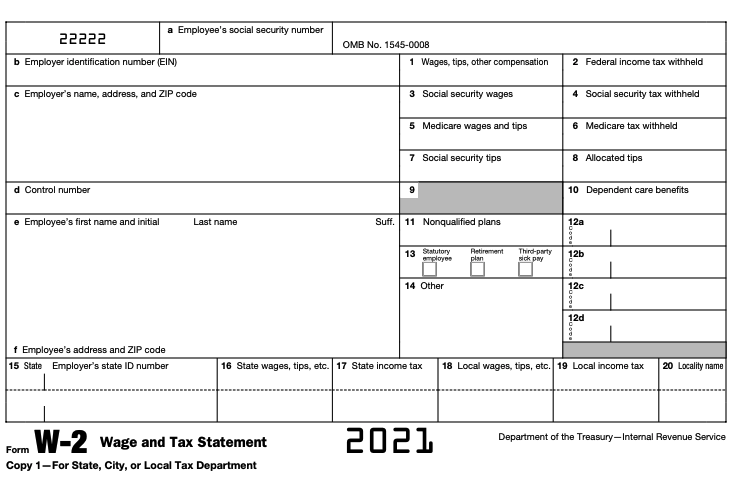

. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. This is 9675 more than the maximum weekly benefit for 2021. Employee-paid premiums should be deducted post-tax not pre-tax.

The description have not being added on the drop down menu of the W2 worksheet forcing to list it as Other. Employees earning less than the Statewide Average Weekly Wage SAWW. Paid Family Leave Helpline.

EMPLOYEE CONTRIBUTION Employers may collect the cost of Paid Family Leave through payroll deductions. The description for this entry is PAID FAMILY LEAVE. Your employer will not automatically withhold taxes from these benefits.

You will receive either Form 1099-G or Form 1099-MISC. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. The maximum contribution is 19672 per employee per year.

67 of the employees average weekly wage or 67 of the statewide average weekly wage whichever is less. Verify the New York Paid Family Leave item are there. On August 25 2017 the New York State Department of Taxation and Finance DFS released highly anticipated guidance regarding taxation of PFL benefits and premium in Notice N-17-12.

Requirements for other types of employers are. To update your rate or add your account. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

NYGOVPAIDFAMILYLEAVE PAGE 1 OF 2 NEW YORK STATE PAID FAMILY LEAVE. The employee requesting leave. Select the Payroll Info tab and select Taxes.

The program provides up to 12 weeks of paid family leave benefits paid at 67 of the employees average weekly wage up to a pre-determined cap to most employees in New York. Bond with their child during the first 12 months after birth adoption or fostering of a child. Go to Employees and select Employee Center.

For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836. New York designed Paid Family Leave to be easy for employers to implement with three key tasks. Benefits paid to employees will be taxable non-wage income that must be included in federal gross income.

The maximum annual contribution is 38534. For the last couple of years NYS have being deducting premiums for the Paid Family Leave program. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Use Paid Family Leave. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service.

The maximum annual contribution is 42371. New York paid family leave benefits are taxable contributions must be made on after-tax basis. If your employer participates in New York States Paid Family Leave program you need to know the following.

1 Obtain Paid Family Leave coverage. The law allows eligible employees to take paid family leave to. Get answers to your questions or other assistance on Paid Family Leave by calling the toll-free Helpline at 844 337-6303.

Contribution rate for Paid Family Leave in 2020 is 0270 of the employees weekly wage capped at New Yorks current average annual wage of 7286084. Fully funded by employees. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave.

Any benefits you receive under this program are taxable and included in your federal gross income. Double-click the employees name to open the Edit Employee window. In 2021 the contribution is 0511 of an employees gross wages each pay period.

3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave. A New York State tax credit that offers savings for hiring individuals with disabilities. Labels ProSeries Professional Reply.

You may request voluntary tax withholding. The employee submits the completed. What category description should I choose for this box 14 entry.

Paid Family Leave provides eligible employees job-protected paid time off to. In the Taxes screen that pops up select the Other tab. New York Paid Family Leave is insurance that may be funded by employees through payroll deductions.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. The maximum employee contribution in 2018 shall be 0126 of an employees weekly wage up to the annualized New York State Average Weekly Wage. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program has tax implications for New York employees employers and insurance carriers including self-insured employers employer.

This deduction shows in Box 14 of the W2. Paid Family Leave may also be available. The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a.

Here are the key points. To set up the New York Paid Family Leave deduction as a tax code do the following. For 2021 the contribution rate for Paid Family Leave will be 0511 of the employees weekly wage capped at the New York.

Select OK twice to close the window. N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages. You must review and verify the rates with the agency since they can change each tax year.

These steps and images are meant to give you an understanding of how to set up this tax code not to communicate the current tax rates. Vacation and Personal Leave. On the 2020 edition there is no Other option please see the screenshot above.

Pursuant to the Department of Tax Notice No. Employers may offer employees the option of using any accrued unused paid vacation or personal. Is responsible for the completion of these forms.

2 Collect employee contributions to pay for their coverage.

Here S How Much Money You Take Home From A 75 000 Salary

Paid Family Leave For Family Care Paid Family Leave

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Amendment To Tax Law Section 1404 A Regarding Calculation Of New York State Transfer Taxes Grossing Up World Wide Land Transfer

Paid Family Leave Expands In New York The Cpa Journal

How To Read Your W 2 Justworks Help Center

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Consulting

State Rankings On Economic Well Being For Children 2013 From The 2013 Kids Count Data Book From The Annie E Casey Foun Counting For Kids Kids Health Health

Professional Bakery Invoice Business Notepad Zazzle Com In 2022 Custom Notepad Note Pad Custom

Education Cost Split By State Higher Education Public University Education

Is My Stimulus Payment Taxable And Other Tax Questions The New York Times

Your Rights And Protections Paid Family Leave

New York State Paid Family Leave Cornell University Division Of Human Resources

Cost And Deductions Paid Family Leave

New York Paid Family Leave Updates For 2022 Paid Family Leave